Are you ready to take the exciting plunge into homeownership? As a first-time homebuyer, you might have been instantly bombarded by a plethora of information about mortgage loans, interest rates, and down payment requirements. You may also have heard about different loan programs specifically designed for first-time homebuyers. These programs can offer benefits like lower down payments, more flexible credit requirements, and assistance with closing costs. But are these programs good for you? In general, what loan program will be the best for you as a first-time homebuyer? Let’s find out.

FHA Loans

Looking into FHA loans could be a smart move for first-time homebuyers. These loans are strongly backed by the Federal Housing Administration and offer more lenient qualification requirements compared to conventional loans. With a lower down payment requirement of as little as 3.5% and flexible credit score criteria, FHA loans can be a sexy, attractive option for those with limited savings or very low credit scores. In fact, FHA loans allow financial gifts from family members to cover part or all of the down payment. This can be extremely beneficial for buyers who may not have enough saved up on their own.

Looking into FHA loans could be a smart move for first-time homebuyers. These loans are strongly backed by the Federal Housing Administration and offer more lenient qualification requirements compared to conventional loans. With a lower down payment requirement of as little as 3.5% and flexible credit score criteria, FHA loans can be a sexy, attractive option for those with limited savings or very low credit scores. In fact, FHA loans allow financial gifts from family members to cover part or all of the down payment. This can be extremely beneficial for buyers who may not have enough saved up on their own.

VA Loans

Are you a veteran or active-duty service member dreaming of owning your first home? VA loans could be the perfect option for you. These loans are supported by the U.S. Department of Veterans Affairs, offering benefits like no down payment requirements and competitive interest rates. What makes VA loans a great option for many is the that they don’t require private mortgage insurance (PMI). Of course, it means you can save much more money in the long run. Additionally, these loans have more flexible credit and income requirements compared to conventional mortgages, making them accessible to a wider range of borrowers. VA loans also limit closing costs and fees that lenders can charge, potentially reducing your out-of-pocket expenses when buying a home. Plus, if you encounter financial difficulties down the line, the VA offers assistance programs to help veterans avoid foreclosure.

USDA Loans

These loans are backed by the United States Department of Agriculture and cater to buyers in rural areas or small towns. One major perk is that they require no down payment, making homeownership more attainable for many. USDA loans also offer great interest rates and super flexible credit requirements, making them ideal for those with limited financial resources. Additionally, borrowers can finance up to 100% of the home’s purchase price, reducing the need for upfront cash. To qualify for a USDA Loan, your income must fall within certain limits based on location and family size. The property you’re purchasing must also meet specific criteria set by the USDA regarding its location and condition.

203(k) Rehabilitation Loans

But what if you’re a first-time homebuyer looking to purchase a fixer-upper? If so, the 203(k) rehabilitation loan might be just what you need. This type of loan allows you to finance both the cost of purchasing the property and the renovations needed to make it your dream home. With a 203(k) loan, you can borrow money based on the future value of the property after the repairs are completed. This means you can tackle major projects like kitchen remodels, bathroom upgrades, or even structural repairs with one convenient loan.

But what if you’re a first-time homebuyer looking to purchase a fixer-upper? If so, the 203(k) rehabilitation loan might be just what you need. This type of loan allows you to finance both the cost of purchasing the property and the renovations needed to make it your dream home. With a 203(k) loan, you can borrow money based on the future value of the property after the repairs are completed. This means you can tackle major projects like kitchen remodels, bathroom upgrades, or even structural repairs with one convenient loan.

A 203(k) loan provides flexibility in terms of property condition. You don’t have to worry about finding a move-in ready home – instead, you can focus on properties that may need some TLC but have great potential. Each type of mortgage loan program caters to different needs and financial situations. By exploring your options thoroughly with the help of a knowledgeable lender, you can find the best fit for your first home purchase journey.…

Tracking your progress is essential to organizing your finances like a pro. It’s crucial to know where you stand financially and how much you’re improving over time. First, keep a budget sheet reflecting all your income and expenses. This simple document will allow you to see exactly where every penny goes each month, making it easier for you to identify areas where you can cut back or save more money. Secondly, use apps or software that can automatically track your spending habits and visually represent your financial situation. These tools can be especially helpful for people who have trouble keeping up with their budgets manually.

Tracking your progress is essential to organizing your finances like a pro. It’s crucial to know where you stand financially and how much you’re improving over time. First, keep a budget sheet reflecting all your income and expenses. This simple document will allow you to see exactly where every penny goes each month, making it easier for you to identify areas where you can cut back or save more money. Secondly, use apps or software that can automatically track your spending habits and visually represent your financial situation. These tools can be especially helpful for people who have trouble keeping up with their budgets manually.

You will need to have a service to manage your IRA account and an investment strategy. This can be done with the help of a financial advisor. This is one of the best financial strategies for retired people because it provides them with a way to make money without having to go back to work.

You will need to have a service to manage your IRA account and an investment strategy. This can be done with the help of a financial advisor. This is one of the best financial strategies for retired people because it provides them with a way to make money without having to go back to work. One of the biggest expenses that retired people face is healthcare. It’s essential to have a plan for how you will pay for healthcare costs, whether through Medicare, private insurance, or some other method. There are several ways to save on healthcare costs, so be sure to explore all your options. These are just a few of the financial strategies that can help retired people stay on top of their finances. If you’re nearing retirement, be sure to consult with a financial advisor to get started on creating your own retirement plan. With a bit of planning and preparation, you can ensure that you’ll have a comfortable and financially secure retirement. Please share this article with your friends and family who may be nearing retirement. Thanks for reading.…

One of the biggest expenses that retired people face is healthcare. It’s essential to have a plan for how you will pay for healthcare costs, whether through Medicare, private insurance, or some other method. There are several ways to save on healthcare costs, so be sure to explore all your options. These are just a few of the financial strategies that can help retired people stay on top of their finances. If you’re nearing retirement, be sure to consult with a financial advisor to get started on creating your own retirement plan. With a bit of planning and preparation, you can ensure that you’ll have a comfortable and financially secure retirement. Please share this article with your friends and family who may be nearing retirement. Thanks for reading.…

It’s essential to shop around for loans. There are various lenders out there, each offering different terms and rates. Shopping around for loans will help you find the best deal possible. Remember, some lenders may offer lower interest rates, while others may have more flexible repayment terms. It’s essential to compare different lenders before choosing one.

It’s essential to shop around for loans. There are various lenders out there, each offering different terms and rates. Shopping around for loans will help you find the best deal possible. Remember, some lenders may offer lower interest rates, while others may have more flexible repayment terms. It’s essential to compare different lenders before choosing one. Before taking out a loan, ask about any applicable fees. Some lenders may charge origination fees, prepayment penalties, or other charges. These fees can add up, so it’s essential to be aware before signing on the dotted line.

Before taking out a loan, ask about any applicable fees. Some lenders may charge origination fees, prepayment penalties, or other charges. These fees can add up, so it’s essential to be aware before signing on the dotted line.

One of the most significant advantages of taking out a

One of the most significant advantages of taking out a  If you have good credit, you may also get a lower monthly payment. It is because lenders typically offer lower interest rates to borrowers with good credit. Therefore, if you have good credit and consolidate your debt into one loan, you may get a more down monthly payment.

If you have good credit, you may also get a lower monthly payment. It is because lenders typically offer lower interest rates to borrowers with good credit. Therefore, if you have good credit and consolidate your debt into one loan, you may get a more down monthly payment.

People who depend on

People who depend on

The best credit repair company online. Epic Credit Score Solutions is owned by Bruce Van Horn, who has been in the business world for over 20 years and knows what it takes to get your life back on track. The team at Epic is not just about “selling” you a product or service. They do what they say they will do when they say they will do it. You can be assured that with Epic Credit Score Solutions on your side, you are getting the best possible chance to restore your credit rating and improve your life as a result.

The best credit repair company online. Epic Credit Score Solutions is owned by Bruce Van Horn, who has been in the business world for over 20 years and knows what it takes to get your life back on track. The team at Epic is not just about “selling” you a product or service. They do what they say they will do when they say they will do it. You can be assured that with Epic Credit Score Solutions on your side, you are getting the best possible chance to restore your credit rating and improve your life as a result. Miami Credit Fix is a credit repair company that helps people in Miami and the surrounding areas to fix their credit. They have a team of experienced and certified professionals who can help you to improve your credit score. Miami Credit Fix offers a wide range of services, including credit counseling, dispute letters, and credit monitoring. They also offer money-back guarantees on all of their services, so you can be sure that you’re getting the best possible service.

Miami Credit Fix is a credit repair company that helps people in Miami and the surrounding areas to fix their credit. They have a team of experienced and certified professionals who can help you to improve your credit score. Miami Credit Fix offers a wide range of services, including credit counseling, dispute letters, and credit monitoring. They also offer money-back guarantees on all of their services, so you can be sure that you’re getting the best possible service.

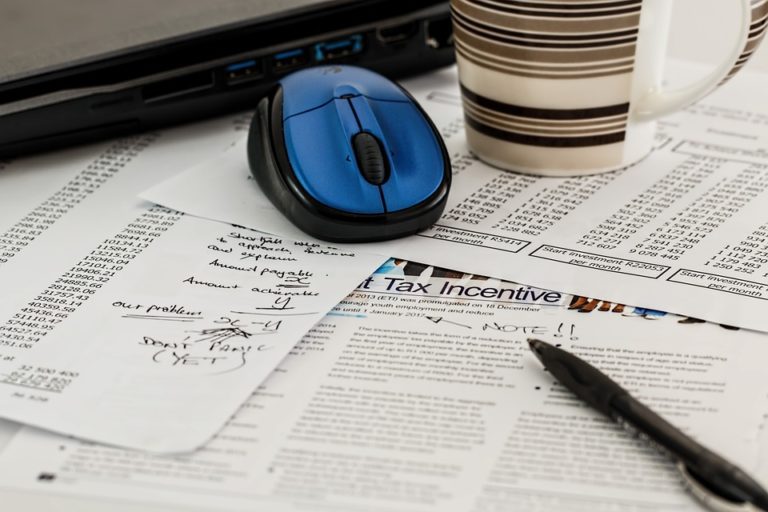

If you want to save time, the best thing to do is to hire a tax accountant. A tax accountant will help you to do the accounting work without wasting your valuable time. As a business, your work should not be to keep stressing about books of account.

If you want to save time, the best thing to do is to hire a tax accountant. A tax accountant will help you to do the accounting work without wasting your valuable time. As a business, your work should not be to keep stressing about books of account.

As much as finances are about numbers, there is more to it. For instance, factors such as predictability and accountability often tend to be ignored. In the process, our companies and other businesses tend to suffer.

As much as finances are about numbers, there is more to it. For instance, factors such as predictability and accountability often tend to be ignored. In the process, our companies and other businesses tend to suffer.